SpaceX, the aerospace manufacturer and space transportation company founded by Elon Musk, has been the subject of much discussion lately. From Twitter threads to financial reports, the company’s exponential growth has caught the attention of experts and enthusiasts alike. But what is driving this growth, and can it be sustained? Let’s delve into the various perspectives to understand the full picture.

The Financials: A Revenue Rocketship

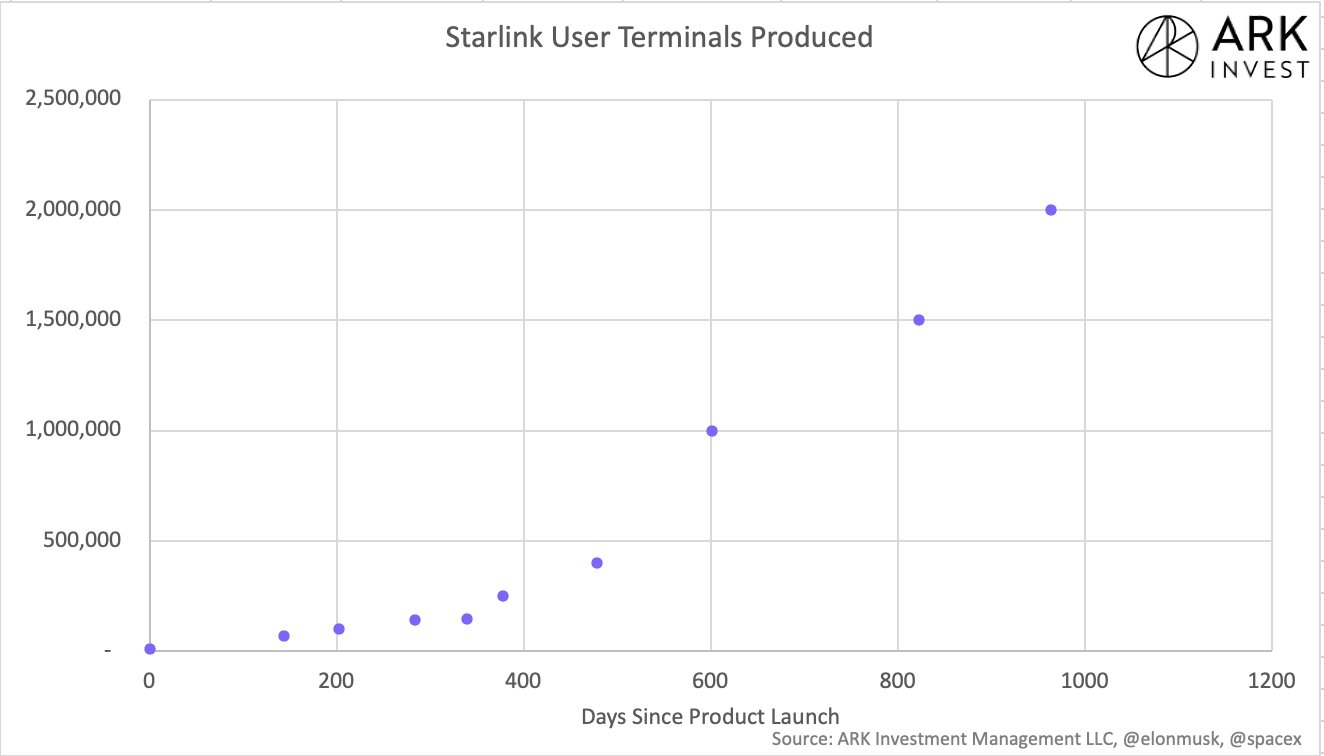

According to social media discussions, SpaceX is generating nearly $2 billion a month in revenue, with almost half a billion coming solely from its internet service, Starlink. If these numbers are accurate, that would amount to a staggering $24 billion in annual revenue. This has led many to question how SpaceX manages to stay cash flow positive, especially if Starlink were to go public.

Pros:

- Diversified Revenue Streams: SpaceX has multiple sources of income, including commercial launches, NASA contracts, and Starlink subscriptions. This diversification helps maintain a robust cash flow.

- Starlink’s Success: Early adopters, especially in rural areas, report excellent service with faster speeds and practically zero drops. This could be a significant revenue driver if it scales globally.

Cons:

- High Operational Costs: Launching rockets and maintaining satellites are not cheap endeavors. The company needs to sustain its revenue growth to offset these costs.

- Regulatory Hurdles: As Starlink expands, it may face regulatory challenges that could affect its profitability.

Technological Advancements: Starship as a Game-Changer

The Twitter community is abuzz with the idea that SpaceX’s upcoming Starship will revolutionize the number of satellites that can be deployed, thereby increasing the user base exponentially.

Pros:

- Increased Payload Capacity: Starship promises to carry much larger payloads than current rockets, making it more cost-effective.

- Reusability: The full reusability of Starship could dramatically reduce the cost per launch, making space travel more accessible.

Cons:

- Unproven Technology: Starship is still in the testing phase. Until it’s operational, it remains a potential rather than a guarantee.

- Environmental Concerns: The increase in the number of satellites could exacerbate the issue of space debris, posing risks to other orbital objects.

Customer Experience: The Ideal Scenario?

Early adopters of Starlink, particularly in rural areas, have reported an ideal customer experience with faster service and fewer drops.

Pros:

- Satisfying a Market Need: Starlink is filling a gap in the market for high-speed internet in rural areas.

- Automatic Upgrades: Customers have reported improvements in service without needing to do anything, indicating strong backend support.

Cons:

- Limited User Feedback: The overwhelmingly positive reviews come mainly from early adopters, which may not represent the broader customer base.

- Scalability: As the user base grows, maintaining the same level of service quality could be challenging.

Conclusion

SpaceX’s exponential growth is undoubtedly impressive, driven by diversified revenue streams, technological advancements, and strong customer experiences. However, it’s essential to consider the challenges ahead, including operational costs, regulatory hurdles, and scalability issues. As the company continues to push the boundaries of what’s possible, only time will tell if this growth trajectory is sustainable in the long run.

Disclaimer: The financial figures and user feedback mentioned are based on social media discussions and should be verified for accuracy.