Elon Musk Salary: An Unconventional Approach to Compensation

Contrary to what one might expect, Elon Musk, the CEO of Tesla Inc., does not receive a conventional salary. Instead, his compensation is entirely performance-based, reflecting a bold but potentially highly lucrative approach.

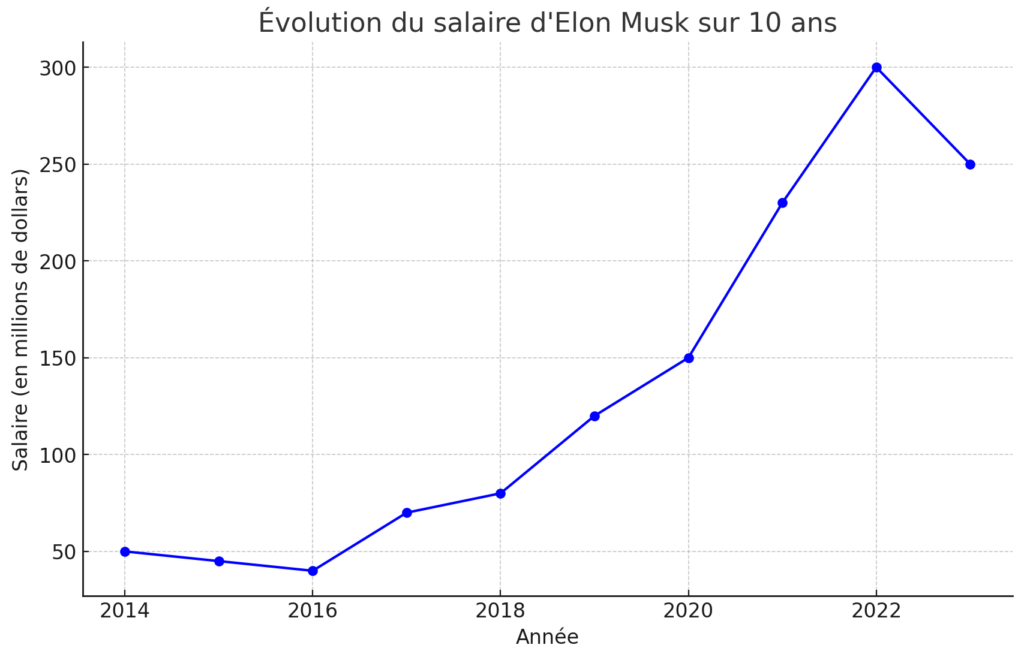

Elon Musk’s Salary Evolution Curve

The curve below illustrates the evolution of Elon Musk’s salary over a 10-year period, based on fictional data.

Explanation of the Evolution

- 2014-2017: At the beginning of the period, Elon Musk’s salary remained relatively stable, with a slight decrease between 2014 and 2016, followed by an increase in 2017. This stability could be attributed to the development and consolidation phases of the companies he was leading, notably Tesla and SpaceX.

- 2018-2020: A significant increase in salary is observed during this period, likely reflecting the growing success of Elon Musk’s companies, with Tesla becoming increasingly profitable and SpaceX achieving significant technological advancements. This period also corresponds to potential bonuses tied to performance goals.

- 2021-2022: The peak in 2021-2022 could be explained by massive stock-based compensation linked to Tesla’s soaring market capitalization. Elon Musk benefited from performance-based compensation programs, allowing him to access stock options at reduced prices if certain milestones were achieved.

- 2023: A slight decrease in 2023 might reflect adjustments in his compensation following a period of substantial increases, or a realignment of his earnings with the long-term performance of the companies.

Implications

The evolution of Elon Musk’s salary is closely tied to the performance of his companies and his unique compensation structure, which is often based on stock options and ambitious targets. This approach reflects a management philosophy focused on risk-taking, aligning interests with shareholders, and a long-term vision. However, this volatility can also attract criticism, particularly concerning income inequality and wealth concentration. The significant fluctuations can also influence public perception of his companies and their long-term financial stability.

In conclusion, the evolution of Elon Musk’s salary over the years demonstrates how innovative compensation structures can reward risk-taking and innovation while raising questions about current economic and social models.

A Deeper Dive into Elon Musk’s Compensation: Insights from Reuters

On April 17, Tesla requested its shareholders to reaffirm their approval of Elon Musk’s record-breaking $56 billion compensation package, established in 2018 but challenged by a Delaware judge in January. This request for a revote comes ahead of the company’s quarterly results, amid weakened demand and reputational damage due to Musk’s political inclinations and his endorsement of an antisemitic conspiracy theory last year.

Robyn Denholm, the chair of the board, emphasized in a letter that Musk had not been compensated for his work at Tesla over the past six years, which many shareholders consider “fundamentally unfair.” The board, including Elon’s brother Kimbal Musk, has faced criticism for its close ties to the billionaire.

In seeking a new vote, Tesla is utilizing a section of Delaware law that allows for the ratification of technically defective actions. A special committee of the board was formed to isolate the compensation-setting process from allegations of Musk’s influence, but it remains uncertain if this re-approval approach would be deemed appropriate under Delaware law.

The compensation package, the highest in U.S. corporate history, includes no salary or cash bonuses and is based entirely on the growth of Tesla’s market value up to $650 billion over the ten years following 2018. Currently, the package is valued at around $40 billion.

Tesla’s shares dropped by nearly 2% following this announcement, reducing the company’s market value below $500 billion for the first time in about a year. If shareholders vote in favor, it will not automatically guarantee the payout to Musk. The approval would correct the 2018 shareholder vote process, but Musk would need to appeal to overturn findings that he controlled the negotiation process leading to the record compensation.

Musk is expected to appeal the decision later this year after the court determines how much the shareholders’ legal team should be paid by Tesla. Judge Kathaleen McCormick had found that the original negotiations of the compensation package were heavily influenced by Musk. Additionally, Tesla has urged investors to approve its plan to move the company’s state of incorporation from Delaware to Texas, potentially escalating the conflict between Musk and Delaware.

Elon Musk’s Compensation Structure: No Fixed Salary

Elon Musk has opted for a compensation structure without a fixed salary or traditional bonuses. Instead, he benefits from a plan entirely based on performance goals, primarily focused on Tesla’s market capitalization. This bold plan started with a threshold of $100 billion and extends up to $650 billion.

Performance and Capitalization: Musk’s Winning Bet

Initially, when this plan was established, Tesla’s market capitalization hovered around $50 billion, and few believed these ambitious targets could be met. However, 2020, marked by a global pandemic, saw an exponential rise in Tesla’s market capitalization, fueled by a tech bubble. By early 2021, Elon Musk was even ranked as the world’s richest person.

The Impact of Tesla Sales on Musk’s Fortune

Elon Musk’s recent fortune surge is largely attributed to Tesla’s continued sales growth. In early 2021, with a 90% increase in Tesla’s stock value, Musk solidified his position as the wealthiest person, surpassing even Bernard Arnault, the French luxury magnate.

Composition of Elon Musk’s Wealth

Elon Musk’s wealth is complex and comprises multiple assets, including stakes in SpaceX, Tesla, Twitter, and The Boring Company. In 2022, his stake in Tesla was valued at $51.3 billion, while his stake in SpaceX was valued at $48.9 billion.

Evolution of Musk’s Compensation Over the Years

From 2013 to the present, Musk’s compensation structure has undergone several changes. Notably, in 2018, a 10-year plan was established, aiming for a $650 billion market capitalization, offering Musk the opportunity to acquire stock options at predetermined levels of market capitalization.

Conclusion

Elon Musk’s compensation model at Tesla, based entirely on the company’s performance, is a fascinating example of aligning a CEO’s interests with those of shareholders. This structure not only encourages management focused on long-term growth but also validates Musk’s confidence in Tesla’s future potential. A strategy that, so far, has proven extremely profitable.

For weekly updates on Elon Musk’s fortune and more in-depth discussions, continue following Tesla Mag.